Berkshire Hathaway Inc. reported a decline in operating earnings of approximately 14% compared to the previous year, while its cash reserves rose to a record high of $347.7 billion as the conglomerate faced challenges in effectively utilizing its funds amid ongoing tariff uncertainties.

The company’s operating earnings, overseen by Chief Executive Officer Warren Buffett, fell to $9.6 billion, according to a statement released on Saturday prior to its annual meeting in Omaha, Nebraska.

Berkshire noted, “Significant uncertainty persists regarding the eventual outcomes of these situations,” in reference to international trade policies and tariffs.

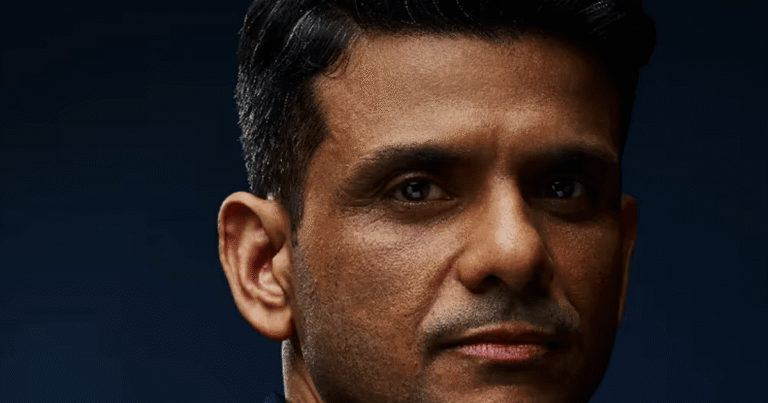

SUN VALLEY, IDAHO – JULY 13: Warren Buffett, Chairman and CEO of Berkshire Hathaway, arrives at a morning session during the Allen & Company Sun Valley Conference on July 13, 2023, in Sun Valley, Idaho. Each July, influential figures from media, finance, technology, and politics gather at the exclusive weeklong conference at the Sun Valley Resort. (Photo by Kevin Dietsch/Getty Images)

During the annual meeting in Omaha, Buffett spoke more directly about tariffs, stating, “I believe there are strong arguments in favor of balanced trade being beneficial for the world. It’s undeniable that trade can escalate into conflict.”

He emphasized that the United States should aim for more trade with the global community.

Berkshire reported that most of its business segments experienced lower revenues and earnings in the first quarter. Analyst Cathy Seifert from CFRA Research suggested that this could indicate a broader economic slowdown.

Seifert commented, “What we’re observing here is Berkshire’s sensitivity to the slowing overall economy.”

For the third consecutive quarter, the company chose not to repurchase any of its own shares, which Seifert interpreted as a sign that the stock might be “too highly valued for Berkshire’s preferences.”

As of the end of March, Berkshire’s five largest holdings remained American Express Co., Apple Inc., Bank of America Corp., Coca-Cola Co., and Chevron Corp.

According to the statement, Berkshire Hathaway was a net seller of $1.5 billion in equity securities during the quarter.

The investment income from the insurance division increased by 11% to $2.9 billion, driven by a 31% rise in interest and other investment income as the conglomerate maintained a larger volume of Treasury bills.

Geico, Berkshire’s auto insurance arm, reported a rise in earnings as it continued to attract more customers. However, expenses also went up as the insurer worked to expand its market share.

Nonetheless, the underwriting earnings for the insurance unit nearly halved during the quarter, partly due to roughly $860 million in after-tax losses associated with the California wildfires.

Berkshire’s market capitalization has remained above $1 trillion since late January, reaching a price-to-book ratio of 1.79 at the close of trading on Friday.

For more business updates, follow Newsstate24 Profit.