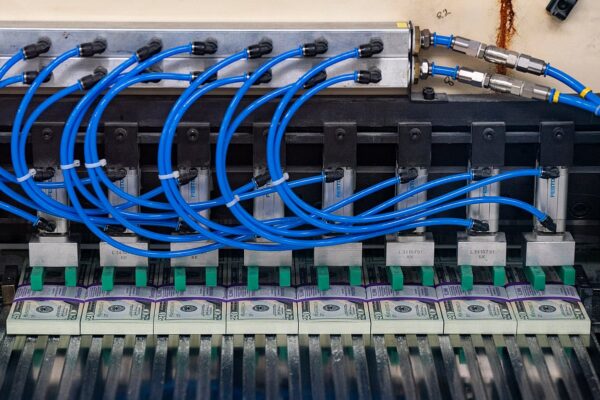

The greenback is on tempo for its worst efficiency in the course of the first 100 days of a US presidency since Richard Nixon was within the White Home as Donald Trump imposes tariffs and makes an attempt to reshape international commerce.

Trump’s commerce coverage — geared toward rejuvenating home manufacturing, shoring up the economic base and enhancing nationwide safety — has pushed buyers into property exterior of the US. That’s led to a weakening within the buck and lifted different currencies alongside gold.

In the meantime, information this week confirmed China stays depending on international demand and South Korean exports to the US declined this month. Authorities forecasts pointed to a German economic system that may wrestle to develop this yr.

Listed below are a few of the charts that appeared on Bloomberg this week on the most recent developments within the international economic system, markets and geopolitics:

US And Canada

A greenback gauge is on observe for its worst efficiency in the course of the first 100 days of a US presidency in information going again to the Nixon period, when America deserted the gold customary and switched to a free-floating change price. The US greenback index has misplaced about 9% between Jan. 20 — when Trump returned to the White Home — and April 25, placing it heading in the right direction for the most important loss by way of the top of the month since at the very least 1973.

Forecasters see the US economic system taking a success from Trump’s commerce coverage. The economic system is ready to develop 1.4% in 2025, in response to the most recent Bloomberg survey of economists, in contrast with 2% in final month’s ballot. The median respondent now sees a forty five% likelihood of a downturn within the subsequent 12 months, up from 30% in March.

Canada’s subsequent prime minister is ready to inherit a half-year of flat financial progress, economists predict, a right away check of their governance as President Donald Trump’s commerce conflict grinds enterprise funding and exports decrease.

Asia

China’s stronger-than-expected progress within the first quarter masks a key vulnerability: a rising dependence on international demand, which will increase the specter of a sharper financial hit as commerce tensions soar. The sturdy contribution from commerce additionally exhibits how fragile the home economic system stays because it faces stress from deflation, sluggish client demand and a chronic property hunch.

Service costs amongst companies in Japan stayed elevated final month, indicating sustained inflationary pressures earlier than the influence from US tariffs kicks in, because the Financial institution of Japan prepares to set coverage subsequent week.

South Korea’s preliminary April commerce information gave an early glimpse of how US insurance policies may dent shipments of export-reliant economies. It confirmed outbound shipments to the US and China had been down 14.3% and three.4%, respectively, whereas exports to the European Union and Taiwan had been up.

Europe

Germany will in all probability fail to generate even minimal financial progress this yr, in response to revised authorities forecasts, a reminder of the dimensions of the problem dealing with conservative Chancellor-in-waiting Friedrich Merz when he takes workplace subsequent month. Gross home product will possible stagnate after shrinking the earlier two years. Authorities economists beforehand anticipated growth of 0.3% this yr.

European automotive gross sales returned to progress final month for the primary time since December, with positive aspects within the UK and sturdy demand for electrical automobiles making up for weaker gross sales in Germany and France. Demand in Italy and Spain was additionally sturdy.

Rising Markets

Kenya’s economic system is ready to surpass Ethiopia’s to turn into East Africa’s largest this yr, the Worldwide Financial Fund mentioned, after the birr was devalued. The fund estimates Kenya’s gross home product might be $132 billion in 2025, greater than Ethiopia’s $117 billion.

Brazil’s annual inflation accelerated to the very best degree since mid-February 2023 in a report coming days after central financial institution administrators assured buyers that tight financial coverage is working.

World

The Worldwide Financial Fund sharply lowered its forecasts for world progress this yr and subsequent, warning the outlook may deteriorate additional as US President Donald Trump’s tariffs spark a worldwide commerce conflict. The IMF minimize its projection for international output progress this yr to 2.8%, which might be the slowest growth of gross home product since 2020. It might even be the second-worst determine since 2009.

California Governor Gavin Newsom boasted that his state has turn into the world’s fourth-largest economic system, following solely the US, China and Germany in international rankings. The state’s nominal gross home product reached $4.1 trillion final yr, edging previous Japan’s $4.02 trillion, Newsom mentioned in an announcement, citing newly launched IMF country-level information and preliminary state information from the US Bureau of Financial Evaluation.

Central banks in Indonesia, Paraguay, Russia and Uzbekistan all saved rates of interest unchanged this week.

. Learn extra on International Economics by Newsstate24 Revenue.